Three Board Seats Up for Election

Greetings, fellow denizens of Oyster River. I'm sorry to only write around election time, but that's how it works out some years. Better late than never, I suppose.

It's not too late to run for school board. There are three open seats, two at-large seats with a three year term, and the Durham seat, with a one year term this time.

You need to file in person at the SAU office by 5pm this Friday 2/3/2023. (That link only talks about two open seats; the district should fix that.)

The three school board seats are divided into two races: at-large and Durham. The two largest vote getters for the at-large seats are elected.

It's not too late to run for moderator either, but for as long as I've been paying attention Rick Laughton always runs unopposed.

A few people have asked me about running for school board, but as of noon 1/31 only two people have filed to run. Vice Chair Denise Day is running for her fourth term at-large, as she was

first elected in March, 2014.

Surprisingly, former Chair Tom Newkirk has filed to run for the Durham seat. Welcome back Tom! Tom was the T in T.E.A.M. back in 2012, one of the four candidates of the clean slate that gave this blog its

name.

We still need one more candidate to file for at-large in order to fill all the seats. Go for it; you know you want to. If someone wants details on what's involved in running, please feel free to contact me.

Deliberative Session, Tuesday February 7

|

Draft Warrant

click to enlarge |

The ORCSD Deliberative Session is Tuesday February 7th, 7pm. For the first time, it's at the new ORMS recital hall. As I always say, it's a real election where the citizenry gets to amend the budget. It's the vestige of the traditional NH town meeting. Unlike most NH elections, same day registration is usually not available at DS. So you need to be already registered to vote in one of the towns to be given a voting card at DS. There is no provision for remote voting -- to vote at DS you must attend.

Each warrant article (except the ones that elect people) is read at DS, then explained by a board member. Many, such as negotiated contracts, cannot be amended. Some, like the main budget, can. A majority of voters at DS can change those numbers, overriding the judgement of the board. On election day in March the voters get to vote each possibly amended warrant article up or down.

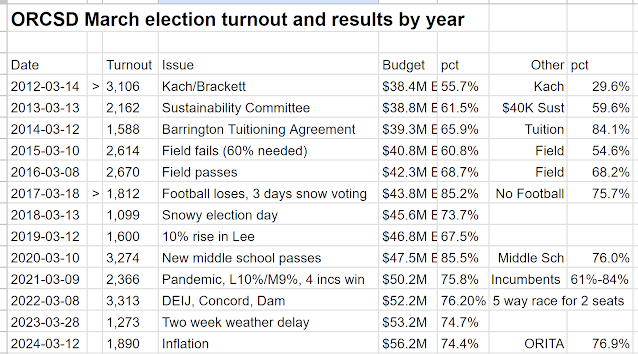

This year the warrant is short. Article 3 is the budget, 52.3 million dollars. If NO wins, we get the default budget, which is $257K (0.5%) less. NO on the budget never wins in Oyster River. Article 4 asks to divert $125K to the fund to buy the middle school solar array. There's the usual fib about "no amount from taxation" -- it really means they got this money through taxation last March and they're not giving it back.

At the Deliberative Session, the only real amendments that make sense are to change these budget numbers. It's too late to petition to add a warrant article; the deadline was Jan 10, 2023.

Attendance at DS varies between around 25 voters in bad weather to around 150 voters when there's a controversial issue. It's worth showing up just to keep a small group of renegades from cutting the budget in half, like what happened in

Croydon. (That's not likely happen here because the voters can always choose the default budget on election day.) See you there.

Board Member Yusi Turell Resigns

We had a surprise before Christmas when board member Yusi Turell resigned, effective March 3, 2023. She stated she was going back to graduate school to complete her Ph.D. She didn't take my advice to "just say no to grad school."

Yusi's conscientious announcement before the filing period allows her seat to appear on the ballot this term, avoiding a board-appointed candidate serving for a partial year, which happens to be how Yusi herself began her board service. Yusi is currently serving in the Durham town-specific seat. There's one year left in her term, so the winner of the Durham seat in March will only serve that one year before the seat goes up for election again in March, 2024 for a full three year term.

Yusi was first appointed in September, 2020 to take over member Kenny Rotner's seat, who had sadly passed away the previous month. I supported Yusi's appointment enthusiastically. Much like Kenny, Yusi was often the conscience of the district, concerned with any negative impacts on any stakeholders as a result of board decisions. While Yusi and I didn't always agree over the ensuing years, I know she always acted in the best interest of the district.

|

| Yusi Turell Resigns |

I'd say her major accomplishments were getting a DEIJ Coordinator for the district and expanding World Languages, especially Mandarin, as well as leading the board's COVID response. I see I'm mostly repeating her resignation letter, which I'll just include here; please click to enlarge.

Thank you very much for your service in these difficult times, Yusi, and good luck with graduate school and all your future endeavors.

Board Chair Michael Williams Retires

In another surprise, this one after Christmas, Chair Michael Williams, whose seat is up for reelection this year, announced he won't seek another term on the school board. Michael has served six years, two as chair. He ran for board and lost in March 2014, was first elected to the board in March, 2017, elected Vice Chair in March 2020, and first elected Chair in March, 2021, when Chair Tom Newkirk decided not to run for chair again.

I've always been a big fan of Michael's. He has an analytic, engineering mind that I can identify with. I can usually count on him to ask the question I've been shouting at the screen. In general he's always taken my writing seriously, reaching out to correct my many mistakes, which I appreciate. I'll miss him.

I was dubious that he'd make a good Chair. He'd always been a bit of an iconoclast, the 1 in a number of 6-1 votes. I thought that rebellious streak wouldn't be compatible with being chair. But I was wrong. Michael is an excellent chair, keeping the board running smoothly under his leadership in a controversial time. I'm sorry to see him go.

His accomplishments as chair are numerous, including guiding the district through COVID, hiring DEIJ and Communication administrators, building the new middle school, and new programs like MTSS (suicide prevention). I think Michael was responsible for the slick and slightly risky plan to finance the new school. It involved two loans spaced over time; fortunately the district locked both interest rates in below 2% I believe, getting done before the recent rate hikes.

|

| Car Charging at ORMS |

In December Chair Williams complained that the $900K spread between the proposed budget and default budget seemed too big. Business Administrator Sue Caswell pushed back, attributing the increase to the high school loan being paid off. That number persisted for a while, but now it's down to $257K. I missed why, but it seems Michael was right.

Michael and I had a little fracas last year when I reported a rumor that the electric car chargers at the middle school would be free. Michael denied that, and I accepted his denial. It turns out the rumor may be correct after all; please see the superintendent's memo on the right. I don't think this has been voted on yet; in that year old post Michael promised a NO vote.

Thank you very much for your service, Michael, and good luck with all your future endeavors.

Business Administrator Sue Caswell Retires |

| Sue Caswell Resigns |

Speaking of Sue Caswell, she too announced her resignation in January. It's been expected for a while that both she and Superintendent Morse would retire this year or the next; the end of an era. Her resignation letter (right) enumerates a number of accomplishments.

Sue's work is always outstanding. We went from having many issues in our annual audit before Sue was in charge, to getting a clean audit report for many years in a row at this point. She recently supervised the move to Tyler financial software for the district, a major project that just started producing the payroll in January. (Coincidentally, the Town of Lee is in the process of abandoning Tyler for another vendor.)

Sue's always been kind to me, taking the time to respond to my inquiries and straightening me out when I go off the deep end on some district finance topic. She started at Oyster River about the same time I started paying attention, so I've never known any other Business Administrator in the district. I was fortunate to be on the finance subcommittee of the strategic plan committee years ago, which was very well run by Sue, and, IMHO, produced a report that put those other subcommittees to shame. I'll miss her.

Thank you for your service and good luck in the future, Sue.

Nutrition Director Doris Demers Retires

|

| Doris Demers Resigns |

Continuing the exodus of board and administrators, Nutrition Director Demers is resigning as well. Doris accomplished many things in her tenure with us. I especially liked her inclusion of fresh, locally sourced food in the menus. There's also the creation and management of the district's End 68 Hours of Hunger program, where food insecure students are discreetly sent home with a backpack of food (and sometimes other items) on Fridays.

Doris was responsible for making free lunch to available to any child during the last few summers, and for arranging for the delivery of meals (free to those eligible, I recall) to homes during the pandemic.

She successfully oversaw the expansion of the Moharimet cafeteria, the upgrade of the Mast Way facilities, and the construction of facilities in the new Middle School.

I'll miss you Doris. Good luck in the future.

We can all catch some of Doris's cooking at the ORHS Sustainability Club's Community Dinner of locally sourced food this Thursday, Feb 2, 5:30 pm at ORHS. I'll see you all there.

High School Students Engage in Risky Behavior

That's not exactly news, is it? What's new is we have the

latest preliminary Youth Risk Behavior Survey (YRBS) results. It's always shocking to read these things. The preliminary results lack the context of the aggregated state results for comparison, so we'll just gawk. This one is dated November 2021, so I think reflects the state pretty deep into the pandemic.

The news on substance use is good, or at least improving. The small silver lining of the disruption caused by a global pandemic, I suppose.

I think "down 16%" on the slide actually means down 16 points, i.e. the 2019 number is 20.9% + 16% = 37%. So this is a pretty huge decline.

The slides in the packet lack some of the numbers I recall hearing at the meeting. Here's a link to the

actual preliminary report. The percentages reported are of the students who answered the question; some questions are widely answered while others aren't; check the report for details.

The sexual and dating violence numbers were particularly disturbing, with 5.2% of ORHS students, including 10.3% of seniors, reporting they had been "physically forced to have sexual intercourse when they did not want to." That sure sounds like rape to me. 39 of the 46 yes respondents were female.

Similarly depressing numbers were: 4.9% of (overwhelmingly female) students report being coerced into sexual behavior with someone at least five years older. 10.9% of (overwhelmingly female) students (81 total) including 15.3% of seniors report experiencing sexual violence last year. 28.2% of students, including 40.1% (!) of female students, reported someone they were going out with tried to purposely control them or emotionally hurt them.

14.8% of students reported making a suicide plan, and 6.9% of students reported attempting suicide last year, with 45.5% reporting they rarely or never sought help when depressed. Wow.

43.4% report texting or emailing while driving -- stop that! 11% of students reported carrying a weapon, 2.2% reported carrying a weapon in school the last 30 days. 4.0% report being threatened with a weapon at school last year. 16.3% report being bullied on school property, 18.4% report being bullied online.

35% of students reported that most of the time their mental health was not good. 4.3% reported their basic needs were not met by adults in their household.

There's more; check out the report.

Spelling Flame

I'm about to engage in the lowest form of internet comment, the spelling flame, frowned upon since at least the early eighties. Unfortunately I think it's warranted as it was an

early press release of our new Communications Specialist Gen Brown, hired in August for $70K + benefits, about $100K annually paid by the district taxpayers.

I really wanted to leave it alone. Due to a glitch I can't seem to fix, I no longer get these emails. This release was first pointed out to me November 23. I saw a facebook post about it a few days later, and I thought for sure it was embarrassing enough that the district would fix it. I procrastinated as long as I could, but here we are two months later and we're still proudly trumpeting the 2022 Excellence Trough Equity Conference [sic] including a student from Oyster River Regional High School [sic]. For the kind of money we're paying, we need to insist our schools are referred to by their correct names.

It's quite an innovative education strategy. In lieu of actual instruction, students just need to drink from the ORCSD Trough of Excellence.

|

| Oyster River Students drink from the Trough of Excellence |

This is going to get me in trouble like the DEIJ Coordinator stuff last year, isn't it? Speaking of which...

As predicted, our DEIJ Coordinator Rachel Blansett spent the first term on a needs assessment, and forming relationships. It's nice to have a job that often includes lunch. Additionally, the superintendent points out, Coordinator Blansett has presented to the NH state legislature and other groups around the state. She has some fun professional development

planned for her second term; here's the summary slide:

I see a "this work" -- time to drink! See you all at the Deliberative session Tuesday, February 7.